Tasting rooms are failing, here’s why.

For as long as we have known, the only way for consumers to experience what a wine brand is all about is by visiting the tasting room. This is not by accident either.

The evolution of the concept “experience” has been defined by the wine industry itself rather than anyone else. The problem this has shaped is that all the focus on brand creation is now resting on the tasting room and wine club, severely limiting other strategic options wineries allow themselves.

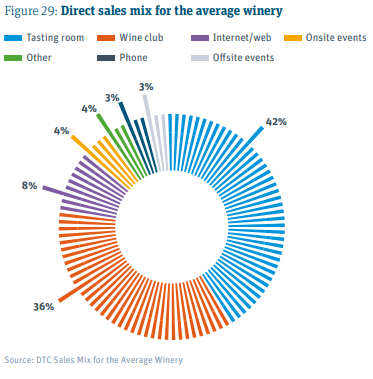

The importance of the tasting room has recently once more been underlined, this time by the 2019 SVB Wine Report showing that 42% of the average wineries total revenue come from tasting room sales. But as the same report shows and states, the tasting room is cracking under the pressure.

Tasting room visitor numbers in the regions of Napa and Sonoma have trended downward for the past five years. There are many reasons for these numbers dropping, but it’s not fewer tourists. Tourism is up however wineries are failing to interest the changed consumer behaviour.

Key factor in maintaining sales growth despite declining visitor numbers has been the focus on average sale value and customer satisfaction. Retail experience and customer satisfaction have been proven to play a vital role in this.

While wine producers with long-established brands still manage to continue to perform above average, the below average performers all share the same characteristics which, according to this report, include failing to collect customer feedback, a lack of sales training, and more.

Key Influencing Factors

Miguel Gomes, assistant professor of horticultural marketing at cornell University, conducted an in-depth study showing that customer satisfaction is directly tied to increased sales (on average one more bottle per visit). Among his main focus points for tasting rooms he included retail execution and atmosphere. Notable is that these were ranked higher than tasting experience.

“Attention to the details of the tasting room experience can convert a “satisfied” customer to a “highly satisfied” customer who will buy one average one additional bottle of wine, spend an additional ten dollars, and is highly likely (92% probable) to become a repeat customer.”

The good news is these details are largely under the control of the winery, the bad news is that many are still relying on wine to sell itself or are failing to increase the amount of non-wine options available for visitors. By their unwillingness or inability to give priority to increasing average sale value these wineries are refusing to take a page out of the playbook of the successful industry giants.

This recent tasting room trend review report actually showed a -2% decrease in sales per taster with smaller wineries (between 1k-6k tasters) performing the worst.

While there definitely are US regions that are showing promising growth figures, such as for example Oregon, the undeniable shifts in consumer behaviour will be a growing concern regardless of geographic location and short-term trends.

Conclusion and Solutions

With the heavy reliance of wineries on DTC sales, and tasting rooms being the main channel for realizing this revenue, more and more tasting rooms are failing to adapt to the market trends and it’s becoming a growing problem.

The shift to online channels, lower trending visitor numbers, and failure to increase average sale per visitor are some of the key factors in play for many wineries involved.

However, as with every problem there are solutions available, most of which can be found in this article offering 6 proven tactics for improving tasting room sales.