Wine Business Podcast Ep 8 – Cristian Ventura

Cristian Ventura is a marketer full of passion who has plenty of experience in wine. So when I asked him to share his thoughts with me about robust marketing in the wine business, he was eager to get on the show.

For more about Avina go to http://avinawinetools.com/trade

To connect with Cristian https://www.linkedin.com/in/cventuram/

Don’t miss the next episode – subscribe now!

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Wine Business Podcast Ep 7 – Marisa Sergi

The Avina Podcast is a show where we talk to interesting people in the wine industry including winery owners, wine retailers, wine industry decision makers, and more.

Whenever we hear about a 25-year old who owns a wine brand, makes her own wine, who has just signed a new deal to stock her products at Walmart then we get excited. And we know you do too..!

That is why we invited Marisa Sergi, founder and CEO of RedHead Wine, to our wine business podcast. Listen in to hear more about her fascinating background as a 3rd generation wine maker, her takes on currently hot wine industry topics, and what she has learned from being in the wine industry.

For more go to http://avinawinetools.com/trade or https://redheadwine.us/. And to make sure you wont miss the next episode subscribe now and we’ll see you next week!

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Wine Business Podcast Ep 6 – Zoltan Nagy

The Avina Podcast is a show where we talk to interesting people in the wine industry including winery owners, wine retailers, wine industry decision makers, and more.

In this episode we are joined by a very special guest. Zoltan Nagy is the author of the best-selling book Wine Queens in which he profiles 57 distinguished Spanish women in the wine industry. Zoltan not only talks about the local Spanish wine industry but also about his wine preferences, experiences, and much more.

For more go tohttp://avinawinetools.com/trade or https://twitter.com/zoltancsabanagy. And to make sure you wont miss the next episode subscribe now and we’ll see you next week!

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Wine Business Podcast Ep 4 – Joshua Moses

The Avina Podcast is a show where we talk to interesting people in the wine industry including winery owners, wine retailers, wine industry decision makers, and more.

In this episode we are joined by Joshua Moses who is the direct sales manager at Cassegrain Wines from New South Wales, Australia. Joshua has a wide range of responsibilities at Cassegrain ranging from eCommerce sales, Cellar Door sales, the wine club, and more. Combined with the fresh pair of eyes he brings to the wine industry he is able to provide us with some unique insights and great stories on wine sales.

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Wine Business Podcast Ep 3 – Chloe Cristallini

The Avina Podcast is a show where we talk to interesting people in the wine industry including winery owners, wine retailers, wine industry decision makers, and more.

In this episode we are joined by Chloe Cristallini who is an expert in social media strategies and tactics for wine industry businesses. Not only do we get to hear about her experiences in Italy and the local wine market, but she also goes over her take on Augmented Reality for wine brands and social media tips&tricks for wineries.

Listen and subscribe to us on:

or

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Wine Business Podcast Ep 2 – Seth Proper

The Avina Podcast is a show where we talk to interesting people in the wine industry including winery owners, wine retailers, wine industry decision makers, and more.

In this episode we are joined by broker Seth Proper of Properwines.com who is a wine industry veteran with over 25 years of experience. Seth always has great insights into the current state and trends of the wine industry and he shares some of his best wine related memories with us.

Listen and subscribe to us on:

or

Subscribe & Download

Want to make sure you never miss out on a new episode? Subscribe to our podcast using your favorite app!

Increase your average margin while solving your clients biggest problem

“Could you solve your customers biggest problem doubling your margins in the process?”

Solving your clients biggest problem

What is the biggest problem your clients face when drinking sparkling wines? When they want just one glass after a tough days work or while enjoying a leisurely lunch?

We all know that the bubbles don’t last and that the cork doesn’t fit back into the bottle as it has expanded after opening. Will your client open the bottle and throw the rest away? This is what happens to 624 million bottles of all types of wine per year within the UK alone!

The good news is that according to the Wine and Spirit Trade Association (WSTA), UK Champagne, non-Champagne and sparkling wine sales hit a record number in 2018. The combined sales of sparkling wines topped out at 311 million bottles within 12 months, creating an industry worth £1.5 billion and more than doubling national expenditure since 2013.

Would you believe however that according to an online study produced by Laithwaite’s Wine, 24% of customers waste sparkling wine because they opened more than they could drink and 30% of them were unable to close the wine in some way. That is over half of the consumer population!

Great business practice

‘Why worry?’, you may say.

Well, it would be great for businesses practice to turn customers into fans by helping them solve this extremely vexing problem of preserving their sparkling wines. They will love you for it and not only will this strengthen your customer relations, it could potentially double your margins as customers buy more sparkling wine.

What if your clients’ problem becomes your problem?

Frustrated consumers are not happy throwing away their leftover wines and with governments now actively promoting ‘responsible drinking and responsible waste management’, we will most likely see a decline in those upwardly trending sales figures as more consumers reject waste. More ‘green’ consumers will decide not to open that expensive bottle as they won’t drink it all at one time, cannot reseal the open bottle and they do not want it to go flat and be wasted.

Of course, there are many very popular wives tales about keeping open sparkling wines fresh including putting a silver spoon or a piece of bread inside the open neck of the bottle. Others say to use a vacuum pump on the bottle, which instead of preserving the fizz – pulls out all the remaining air in the bottle which is responsible for creating the bubbles in the first place! These are exactly what they say they are, wives tales and none of these methods have proven to be effective.

Consumers simply do not know how to keep the fizz in their bubbles and they are unsure about how long a sparkling wine can be consumed after opening. In the Laithwaite’s study, 31% thought that the longest amount of time a sparkling wine could be left open was one to five hours!

Helping your clients to help you

Helping your clients to help you – Turn five hours in to five days.

So could you solve your customers biggest problem doubling your margins in the process? Does this sound too good to be true? What if at Avina Wine Accessories we have the answer to this problem?

We manufacture and produce a premium quality and ergonomically designed Champagne and Sparkling Wine Stopper that can preserve any sparkling wine for up to 5 days! With the stopper, that one glass of sparkling wine at lunch or after work becomes more of a reality instead of a wish.

The current cost of our Champagne and Sparkling Wine Stopper to you is £5.39 with a RRP of £12.99 (inc.VAT) – so for every product that you sell, you get a 100% margin.

Once your client has purchased the stopper, they are much more likely to purchase and to drink more sparkling wine knowing that they can happily preserve the contents for much longer than before. They will not hesitate to open that chilled bottle sitting in the fridge.

.jpg)

So that means that when your profit on a particular sparkling wine is also double its cost price, your revenue will double too! The result is increased sales and margin for you and less wastage for the customer. A win-win situation for you, for a greener planet and your happy, satisfied client.

Request your free sample of the Champagne and Sparkling Wine Stopper here.

Not only do the stoppers function well but they also look great. All Avina products come with a lifetime guarantee which means that your customer only has to make this purchase once while they keep coming back to you for more sparkling wine.

We would love for you to take a look and try out our product. Request your free sample of the Champagne and Sparkling Wine Stopper below.

Our top 5 wine business studies of 2018

How do you make a small fortune? Start with a large fortune and then open a winery. Yes, it’s an old joke, however it’s one that could very well apply to you or someone you know if you’re reading this. The wine business is a tricky one, but also a highly rewarding and interesting one.

Proof of this is the impressive amount of studies that have been done on the economics and consumer behaviour surrounding wine and wine making. Over the years we have dissected many industry specific case studies to try and keep up with the fast pace of changes that we are faced with today.

In this article we have compiled five of our favorite studies of 2018 that we believe could benefit other wine industry professionals.

2018 Silicon Valley Bank Wine Report

While this is more of a report rather than a study we would not dare keep this from you. Written by Rob McMillan, EVP and founder of Silicon Valley Bank’s Wine Division, this is probably the most authoritative annual report that does a great job of giving us a clear picture of current conditions, while providing a unique forecast based on micro- and macroeconomic and behavioral trends.

In the 2018 report, Mr. McMillan says that “successful wineries 10 years from now will be those that adapted to a different consumer with different values – a customer who uses the internet in new and interactive ways, is frugal and has less discretionary income than their generational predecessors.”

This is something that we expanded on in our article “ Why Wineries Need to Expand Their Sales Opportunities”.

The report that takes author Rob McMillan 4 months to make each year, provides the reader with more than enough evidence about the current state of the wine industry and what is influencing existing or emerging trends.

Percentage of growth for wineries in US

Closing with bold, yet data backed forecasts this report is proving to be a go to source for many of our business decisions and a must read for any wine professional.

The full study can be found here

Sonoma School of Business and Economics: Wine Business Case Research Journal

While this one is technically not a study but a journal full of studies, we doubt our readers would mind us sharing this one. At Sonoma School of Business and Economics, several contributors have kept a journal of wine studies.

Their description reads: “Welcome to the Wine Business Case Research Journal. Our mission is to provide exceptional decision-focused case studies involving real people and real events in the global wine business context. We will publish multimedia cases as well as cases in traditional document format. These cases are grounded in field research to illustrate the complex challenges that wine businesses contend with today.”

The WBCRJ is published by the Wine Business Institute at Sonoma State University. The Journal is dedicated to enhancing case research and publishing exceptional teaching cases in an electronic format. A unique feature of this journal is to provide an industry digest of each issue’s cases for dissemination, thereby informing global wine researchers and industry practitioners about cutting-edge challenges and possible exemplary solutions.

Volume I, issued spring 2016, can be found here

Volume II, issued spring 2018, can be found here

Making a connection: tasting rooms and brand loyalty

Branding in the wine industry has been one of our main focus points from a business perspective which is why it should be no surprise to find more that one study on the subject in this top 5 list. This study by Joanna Fountain, Nicola Fish, and Steve Charters the researchers look at the value of the winery tasting room as an avenue for relationship building with consumers and its effects on brand loyalty.

As to its findings, Emeraldinsight states: “Establishing brand loyalty through a winery tasting room experience requires more than just good wine or good service quality, it requires an experience which is personalised and which establishes an emotional connection between the visitor and the winery, their product and winery staff. Generally smaller wineries are making this emotional connection more effectively than larger wineries.

By contrast, staff at small and larger wineries alike were making little effort to establish concrete links to instil brand loyalty with the wine tourist post‐visit by encouraging repeat visitation or promoting their mailing lists or even eliciting wine sales.”

While the study is by no means as thorough as the aforementioned SVB Wine Report, due to the relatively small number of consumers the researchers focused on, it is definitely an interesting read.

The full study can be found here

Globalization And The Emergence Of New Business Models In The Wine Industry

Dating back to 2005 this study is slightly older than the others, but this is where some of its strengths lie. As a reader we are in the unique opportunity to look at these predictions with the information and insights the writer was lacking at the time, and see how they have played out over time.

The abstract from the study by Richard M. Castaldi and his team from San Francisco State Universityreads: “The forces of globalization have dramatically altered the international competitive landscape of the wine industry. This paper identifies and analyzes four new business models that have emerged among major industry competitors as wineries strive to create sustainable sources of competitive advantage.”

Business models according to Castaldi

In the study Mr. Castaldi identified four different business models back in 2005. These models are classified as “Largest Player”, “Lone Ranger”, “Wine Groups”, and “Diversified Conglomerate”. Each business model has attributes that can help create competitive advantages, according to Castaldi.

For example, both the Largest Player and Wine Groups business models use economies of scale in innovation, production and marketing as sources of competitive advantage.

Take some time to revisit the past by reading this interesting study on wine industry business models.

The full study can be found right here

Boozing or branding? Measuring the effects of free wine tastings at wine shops

While at first the catchy title caught our attention, the methodology of this study was interesting enough for us to read through this one. By reading out scanner data from wine clubs after hosting a free wine tasting, researcher Larry Lockshin focused on both the sales effects of free wine tastings and the effects on attitudes towards future purchases four weeks after the tastings.

This is a case study that has been put together well with interesting findings: “Scanner data shows a 400 per cent increase in sales of the wines tasted on the day of tasting, and a small but significant effect on sales during the four weeks afterwards.

Only about 33 per cent of the attendees purchase; the other two‐thirds are boozing.”

All together an entertaining read which can be found here.

Tasting rooms are failing, here’s why.

For as long as we have known, the only way for consumers to experience what a wine brand is all about is by visiting the tasting room. This is not by accident either.

The evolution of the concept “experience” has been defined by the wine industry itself rather than anyone else. The problem this has shaped is that all the focus on brand creation is now resting on the tasting room and wine club, severely limiting other strategic options wineries allow themselves.

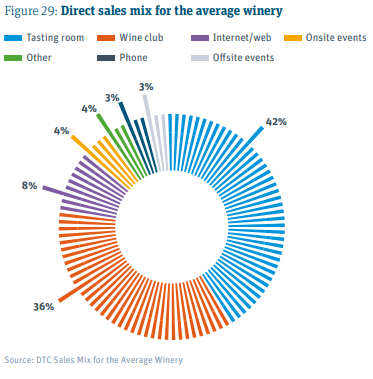

The importance of the tasting room has recently once more been underlined, this time by the 2019 SVB Wine Report showing that 42% of the average wineries total revenue come from tasting room sales. But as the same report shows and states, the tasting room is cracking under the pressure.

Tasting room visitor numbers in the regions of Napa and Sonoma have trended downward for the past five years. There are many reasons for these numbers dropping, but it’s not fewer tourists. Tourism is up however wineries are failing to interest the changed consumer behaviour.

Key factor in maintaining sales growth despite declining visitor numbers has been the focus on average sale value and customer satisfaction. Retail experience and customer satisfaction have been proven to play a vital role in this.

While wine producers with long-established brands still manage to continue to perform above average, the below average performers all share the same characteristics which, according to this report, include failing to collect customer feedback, a lack of sales training, and more.

Key Influencing Factors

Miguel Gomes, assistant professor of horticultural marketing at cornell University, conducted an in-depth study showing that customer satisfaction is directly tied to increased sales (on average one more bottle per visit). Among his main focus points for tasting rooms he included retail execution and atmosphere. Notable is that these were ranked higher than tasting experience.

“Attention to the details of the tasting room experience can convert a “satisfied” customer to a “highly satisfied” customer who will buy one average one additional bottle of wine, spend an additional ten dollars, and is highly likely (92% probable) to become a repeat customer.”

The good news is these details are largely under the control of the winery, the bad news is that many are still relying on wine to sell itself or are failing to increase the amount of non-wine options available for visitors. By their unwillingness or inability to give priority to increasing average sale value these wineries are refusing to take a page out of the playbook of the successful industry giants.

This recent tasting room trend review report actually showed a -2% decrease in sales per taster with smaller wineries (between 1k-6k tasters) performing the worst.

While there definitely are US regions that are showing promising growth figures, such as for example Oregon, the undeniable shifts in consumer behaviour will be a growing concern regardless of geographic location and short-term trends.

Conclusion and Solutions

With the heavy reliance of wineries on DTC sales, and tasting rooms being the main channel for realizing this revenue, more and more tasting rooms are failing to adapt to the market trends and it’s becoming a growing problem.

The shift to online channels, lower trending visitor numbers, and failure to increase average sale per visitor are some of the key factors in play for many wineries involved.

However, as with every problem there are solutions available, most of which can be found in this article offering 6 proven tactics for improving tasting room sales.

Why Branding is Now More Essential Than Ever For Wineries

With the ever ongoing transition in consumer buying behavior from offline channels to online ones many retailers find themselves struggling to keep up. Several reports have shown that businesses who fail to offer their customers a valuable online experience are falling behind. In the winery business, where many are relying on providing an exceptional face-to-face experience in tasting rooms, transitioning to online has proven to be too challenging for most.

“A brand is a company’s most important asset. A company can’t “own” it’s facts. If the company’s facts (speed, price, quality) are superior to the competition, any good competitor will duplicate them or improve on them.”

Just as in any business environment those who fail to adapt are usually the ones left behind and the wine business is no exception to this. While the average number of DTC transactions is in steady decline, the more established wineries are able to raise their average order value due to their strong brand image.

In the 2018 SVB Wine Report research shows consumers are placing more value in the experience and connection with a brand rather than just comparing features such as price. However, when comparing offline and online presentation, only a small percentage of entrepreneurs in the wine industry have implemented a consistent image to consumers over multiple touch points in order to build brand recognition.

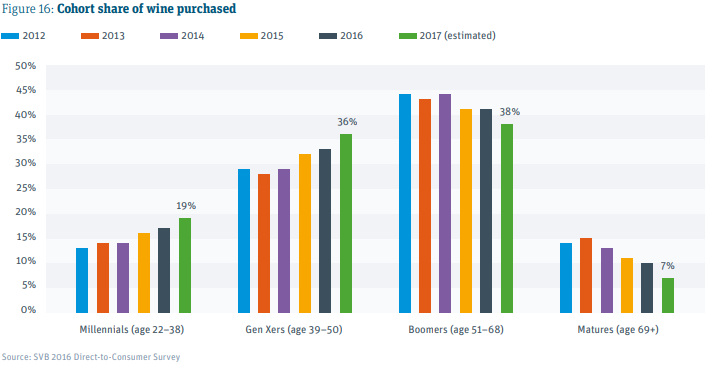

One more variable to consider for business owners is the changing landscape of the consumers they are targeting. Now representing 19 percent of the current fine wine consumption the millennials are a presence whose impact has falsely been overestimated by the wine industry. This goes to show the fine wine industry has up until now failed to activate the new generation of consumers.

As the millennial generation is approaching their prime spending era, marketing efforts should be aimed at the preferences that are unique to this new segment of consumers entering the wine market.

Factors that play a key role in this are, amongst others, the wineries online presence as well as the environmental policies of the winery. A study carried out by Sonoma State University students amongst millennials clearly showed that website quality was a significant predictor of increased trust in the winery and perceptions of the quality of the wine.

In a different study carried out by the same researchers data suggested: “consumer perceptions about product quality, consumer trust, consumer perceptions about pricing, and positive expectations for the consequences of the wineries actions undertaking the pro-environmental policies, all have strong, positive relationships with the wineries brand equity.”

Most notable point in this is how a positive feeling towards a wine brand directly impacts perceptions of product quality. This goes to show that in order to influence DTC buying behavior winemakers are best off diverting at least part of their focus to building strong, lasting relationships with their consumers.

Examples of Strong Branding Efforts

While not all wine makers seem to be ready to make a strong impact on their brand equity in 2019 there are some positive outliers to be found. One of those examples is the oldest winery in Napa Valley, Charles Krug, who is staying young in the branding department. In our recent case study done on the brand building efforts by the iconic winemaker we went deeper into what tactics work best for the Krug family.

You can download the full case study right here

Granite Creek Vineyard

One more winemaker that is leveraging the power of brand building and storytelling is the Granite Creek Vineyard. They are ticking many of the boxes when it comes to valuable qualities to have in 2019 and are putting them to good use.

Their brand is centered around the organic nature of their wines, something that will prove to be increasingly important going forward. However, there are many more lessons that can be learned from the Northern Arizona based winemaker that can be applied by wineries that aren’t deploying organic growing operations.

Granite Creek has established a community of wine lovers around their brand by creating their very own wine club (called the ‘Case Club’), hosting tastings, live music shows, and other events. The Case Club builds a connection to the brand, so it is a smart way to improve average customer value and build an audience of fans that can be promoted to over the long term, so it’s also an investment in a profitable future.

Combine this with special Valentines events and it is no surprise the Granite Creek fanbase has grown well into the thousands.

Dalwood Vineyard

Another winery that has been innovative with its branding efforts is Dalwood Vineyard. This UK based, award winning wine maker has found a creative way to both increase the average order value and permanently find its way into people’s homes.

In a time of transition to more digital channels, word of mouth is still the strongest form of marketing available and Dalwood know how important the personal touch is in building brand reputation.

You can read the full case study right here

Actionable Branding Tips for 2019

Focus on the audience – key thing to keep in mind when investing in the story and presence of any brand is the audience you are looking to reach. While it might be tempting to build the brand entirely as you had envisioned it, you run the risk of ending up with a brand that is tailored to just your own preferences. While this could certainly make sense from a hobby perspective, it does not from a business one.

Invest in your online channels – It is now more important than ever to focus on your online channels. A strong website will directly impact the perception prospective customers have about the quality of your products and combined with a well equipped web shop this will be a safe bet for winemakers in 2019.

Provide great customer service – it is important to keep in mind that customers are expecting more from their experience with your brand which means investing in your offline touchpoints as well. Being omnipresent will keep you top of mind with your audience and will help establish your wine making business as a brand to be trusted.

In the end you don’t have to be world famous to be successful, just famous enough with the right group of people. To sum up:

- Invest in your online presence by sharing your story on various channels

- Have a well equipped web shop to avoid being a ‘one hit wonder’

- Make an effort to keep your brand top of mind with your audience